The Tax Impact

A Community Investment in Walker-Hackensack-Akeley Schools

Common sense improvements, with minimal tax impact.

The referendum plan was designed to address our most critical building needs while keeping the tax impact as low as possible. If approved:

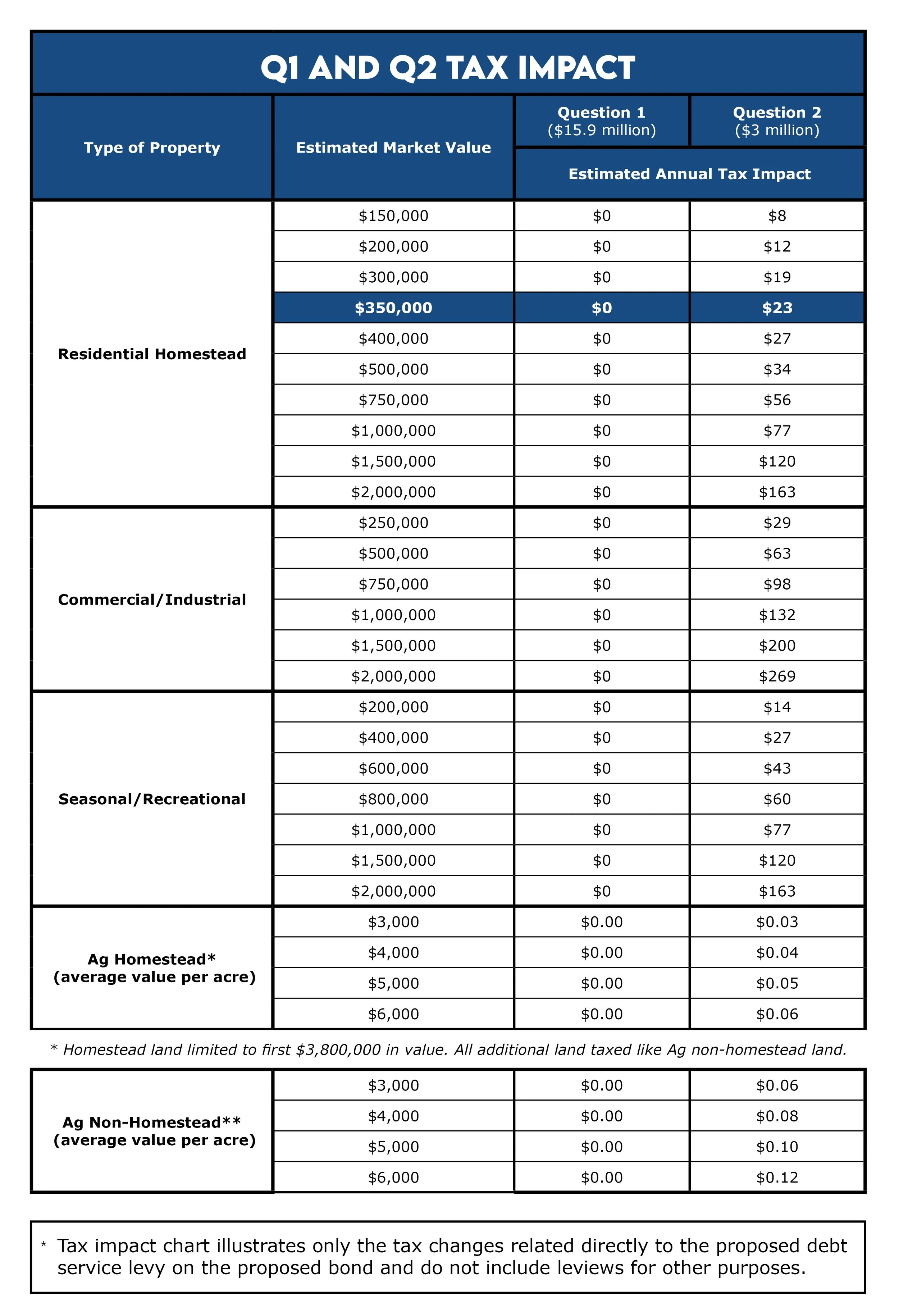

Question One: Will not raise property taxes relative to previous years. The referendum’s new debt will replace expiring debt that is being repaid, keeping taxes stable.

Question Two: Would be supported by a small property tax increase for all property types, including seasonal and recreational properties. For example, if approved:

$1.92/month for a median-value home (approx. $350,000)

$1/month or less for homes valued at $200,000 or less

Calculate your tax impact!

Every resident has the right to know how the referendum will impact their taxes. Our tax calculator can project your specific tax impact using your property’s value. All you need is your parcel ID number.

Don’t know your parcel ID number? You can estimate your tax impact based on the value of your property using our referendum tax table below.

Are there ways to reduce my tax impact?

Yes! Tax credits and deferrals such as the Ag2School credit, Minnesota Homestead Credit Refund or Special Property Tax Refund, and the Senior Citizen Property Tax Deferral can reduce the tax impact of the approved referendum on your home, depending on your age, income, and tax burden.

Ultimately, the decision of whether to make these investments is up to voters. Learn how you can make your voice heard in the election on Tuesday, November 4.